— Blogs —

—Products—

Consumer hotline +8618073152920

Consumer hotline +8618073152920 WhatsApp:+8615367865107

Address:Room 102, District D, Houhu Industrial Park, Yuelu District, Changsha City, Hunan Province, China

Product knowledge

Time:2025-05-09 15:33:50 Popularity:1094

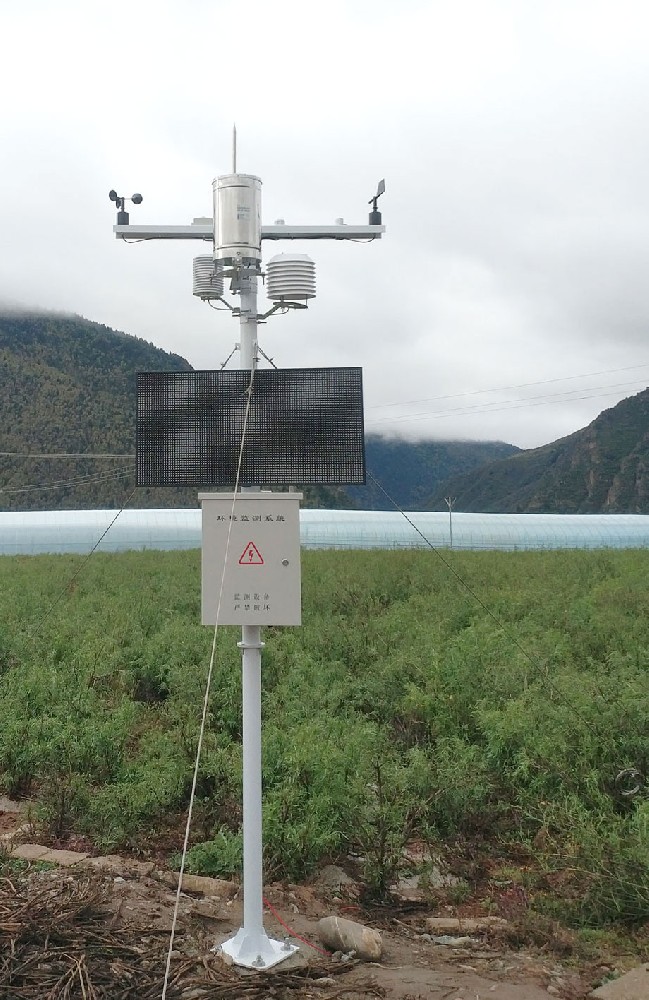

Small-scale weather stations are transforming agricultural insurance by providing precise, localized data that empowers insurers and farmers to manage risks effectively. These compact devices deliver real-time insights into weather conditions like temperature, rainfall, and wind speed, enabling data-driven decisions that enhance insurance products and promote sustainable farming. Below, we explore the key applications of weather station data in agricultural insurance and illustrate their impact through practical case studies.

Weather station data allows insurers to evaluate crop risks with high accuracy. For instance, excessive rainfall can lead to flooding or soil erosion, while prolonged droughts threaten crop survival. By analyzing localized weather patterns, insurers can better predict potential losses and tailor coverage to specific risks.

Combining weather station data with Geographic Information Systems (GIS), insurers can create customized insurance plans based on a farm’s unique location and climate. These precision products ensure farmers receive coverage that matches their specific needs, while insurers benefit from more accurate risk profiles.

Weather stations enable the development of early warning systems that alert farmers to extreme weather events, such as frost, droughts, or storms. Timely notifications allow farmers to take preventive measures, reducing losses. Meanwhile, insurers can adjust their risk exposure based on these alerts, ensuring financial stability.

Insurers can use weather station data to verify the legitimacy of insurance claims. By cross-referencing claim details with localized weather records, insurers can confirm whether losses align with reported weather events, streamlining the claims process and reducing fraud.

Weather data informs more accurate pricing models by providing insights into factors like rainfall and temperature, which influence crop yields and disease risks. This allows insurers to set premiums that reflect true risk levels, benefiting both the insurer and the farmer.

Insurers and farmers can share weather station data to drive better outcomes. Farmers gain access to actionable insights for improved farm management, while insurers gain a deeper understanding of risks, enabling more precise underwriting and product development.

In the event of a disaster, weather station data provides critical evidence to support claims. Detailed records of weather events—such as the timing, location, and severity—help insurers validate claims and ensure fair, timely payouts.

An agricultural insurer partnered with farmers to deploy small-scale weather stations across diverse regions. By integrating this data with GIS technology, the insurer developed tailored insurance products that accounted for local climate conditions and crop types. This approach enabled competitive premiums, attracting more farmers while reducing the insurer’s risk exposure.

A forward-thinking insurer implemented a weather station-based early warning system to monitor for extreme weather risks, such as frost or heavy storms. When potential threats were detected, automated alerts were sent to farmers, prompting actions like crop protection or early harvesting. This system not only minimized losses for farmers but also allowed the insurer to manage risk proactively.

To combat fraudulent claims, an insurer integrated weather station data into its claims process. When a farmer reported crop losses due to drought, the insurer cross-checked the claim against local weather records. This data-driven approach ensured claims were processed quickly and fairly, building trust with policyholders.

In a cooperative model, an insurer provided farmers with access to weather station data to optimize planting and irrigation decisions. In return, the insurer gained valuable insights into local risk factors, enabling more accurate underwriting. This partnership improved farm productivity and strengthened the insurer’s risk management strategy.

The integration of small-scale weather station data into agricultural insurance delivers significant advantages:

· For Insurers: Enhanced risk assessment, reduced fraud, and optimized pricing models lead to lower financial risks and improved operational efficiency.

· For Farmers: Access to tailored insurance products, early warnings, and data-driven farming insights promotes resilience and productivity.

· For Sustainability: Data-driven insurance supports sustainable farming practices by encouraging proactive risk management and resource optimization.

Small-scale weather stations are revolutionizing agricultural insurance by providing granular, real-time data that drives smarter decisions. From precision pricing to early warnings and claims verification, these tools empower insurers to offer better products while helping farmers mitigate risks. By embracing this technology, the agricultural insurance industry can foster greater efficiency, fairness, and sustainability, benefiting stakeholders across the value chain.

Prev:Guide to Installing and Maintaining a Small Meteorological Station

Next:System Composition and Technical Architecture of Forest Fire Meteorological Stations

Related recommendations

Sensors & Weather Stations Catalog

Agriculture Sensors and Weather Stations Catalog-NiuBoL.pdf

Weather Stations Catalog-NiuBoL.pdf

Related products

Combined air temperature and relative humidity sensor

Combined air temperature and relative humidity sensor Soil Moisture Temperature sensor for irrigation

Soil Moisture Temperature sensor for irrigation Soil pH sensor RS485 soil Testing instrument soil ph meter for agriculture

Soil pH sensor RS485 soil Testing instrument soil ph meter for agriculture Wind Speed sensor Output Modbus/RS485/Analog/0-5V/4-20mA

Wind Speed sensor Output Modbus/RS485/Analog/0-5V/4-20mA Tipping bucket rain gauge for weather monitoring auto rainfall sensor RS485/Outdoor/stainless steel

Tipping bucket rain gauge for weather monitoring auto rainfall sensor RS485/Outdoor/stainless steel Pyranometer Solar Radiation Sensor 4-20mA/RS485

Pyranometer Solar Radiation Sensor 4-20mA/RS485

Screenshot, WhatsApp to identify the QR code

WhatsApp number:+8615367865107

(Click on WhatsApp to copy and add friends)